5 Easy Facts About Transaction Advisory Services Described

Table of ContentsExcitement About Transaction Advisory ServicesTransaction Advisory Services Fundamentals ExplainedSome Ideas on Transaction Advisory Services You Should KnowTop Guidelines Of Transaction Advisory Services4 Simple Techniques For Transaction Advisory Services

This step makes sure the business looks its finest to potential customers. Obtaining the organization's worth right is important for an effective sale.Deal advisors action in to aid by obtaining all the required details organized, responding to concerns from buyers, and arranging visits to business's place. This constructs trust with buyers and keeps the sale moving along. Getting the best terms is essential. Transaction advisors utilize their know-how to help local business owner take care of hard negotiations, meet purchaser assumptions, and framework offers that match the proprietor's goals.

Fulfilling lawful guidelines is vital in any kind of business sale. They assist business owners in planning for their next actions, whether it's retired life, starting a brand-new endeavor, or managing their newly found riches.

Deal consultants bring a wealth of experience and expertise, making certain that every facet of the sale is managed properly. Via strategic preparation, assessment, and negotiation, TAS helps company owner achieve the highest possible list price. By guaranteeing lawful and governing conformity and handling due persistance along with other offer staff member, deal experts lessen possible risks and obligations.

The Single Strategy To Use For Transaction Advisory Services

By comparison, Large 4 TS groups: Work with (e.g., when a possible customer is carrying out due diligence, or when an offer is closing and the customer needs to incorporate the firm and re-value the vendor's Annual report). Are with costs that are not connected to the offer closing successfully. Earn charges per engagement somewhere in the, which is much less than what financial investment financial institutions gain even on "small deals" (but the collection chance is likewise much greater).

The meeting concerns are very comparable to investment financial meeting concerns, yet they'll focus more on audit and appraisal and less on subjects like LBO modeling. Expect concerns regarding what the Change in Working Capital means, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional just" topics like test balances and exactly how to go through occasions using debits and credit histories instead of monetary statement changes.

The Basic Principles Of Transaction Advisory Services

Specialists in the TS/ FDD groups might also interview monitoring regarding every little thing above, and they'll create a thorough report with their searchings for at the end of the process.

, and the basic form looks like this: The entry-level role, where you do a whole lot of information and economic evaluation (2 years for a promo from here). The next level up; comparable work, yet you obtain the more intriguing bits (3 years for a promo).

In particular, it's hard to get promoted past the Supervisor level due to the fact that few people leave the work at that phase, and you need to start revealing proof of Read More Here your capability to generate income to development. Allow's start with the hours and way of life since those are much easier to define:. There are occasional late nights and weekend break job, however nothing like the frenzied nature of financial investment financial.

There are cost-of-living modifications, so expect lower payment if you're in a more affordable place outside major economic (Transaction Advisory Services). For all settings except Partner, the base pay makes up the bulk of the complete payment; the year-end reward could be a max of 30% of your base pay. Usually, the very best method to enhance your revenues is to switch over to a various firm and bargain for a higher wage and bonus

Getting My Transaction Advisory Services To Work

You could enter company advancement, however financial investment banking obtains harder at this stage due to the fact that you'll be over-qualified for Expert roles. Business finance is still an option. At this stage, you should simply remain try this and make a run for a Partner-level function. If you wish to leave, perhaps relocate to a customer and execute their assessments and due persistance in-house.

The primary trouble is that because: You normally need to join an additional Big 4 group, such as audit, and job there for a couple of years and after that relocate right into TS, work there for a few years and afterwards relocate into IB. And there's still no assurance of winning this IB my response duty due to the fact that it relies on your area, customers, and the employing market at the time.

Longer-term, there is additionally some risk of and since assessing a business's historic monetary information is not exactly rocket science. Yes, humans will always require to be entailed, yet with more advanced innovation, reduced head counts could possibly support customer involvements. That said, the Deal Solutions team defeats audit in regards to pay, job, and leave possibilities.

If you liked this post, you could be interested in reading.

4 Simple Techniques For Transaction Advisory Services

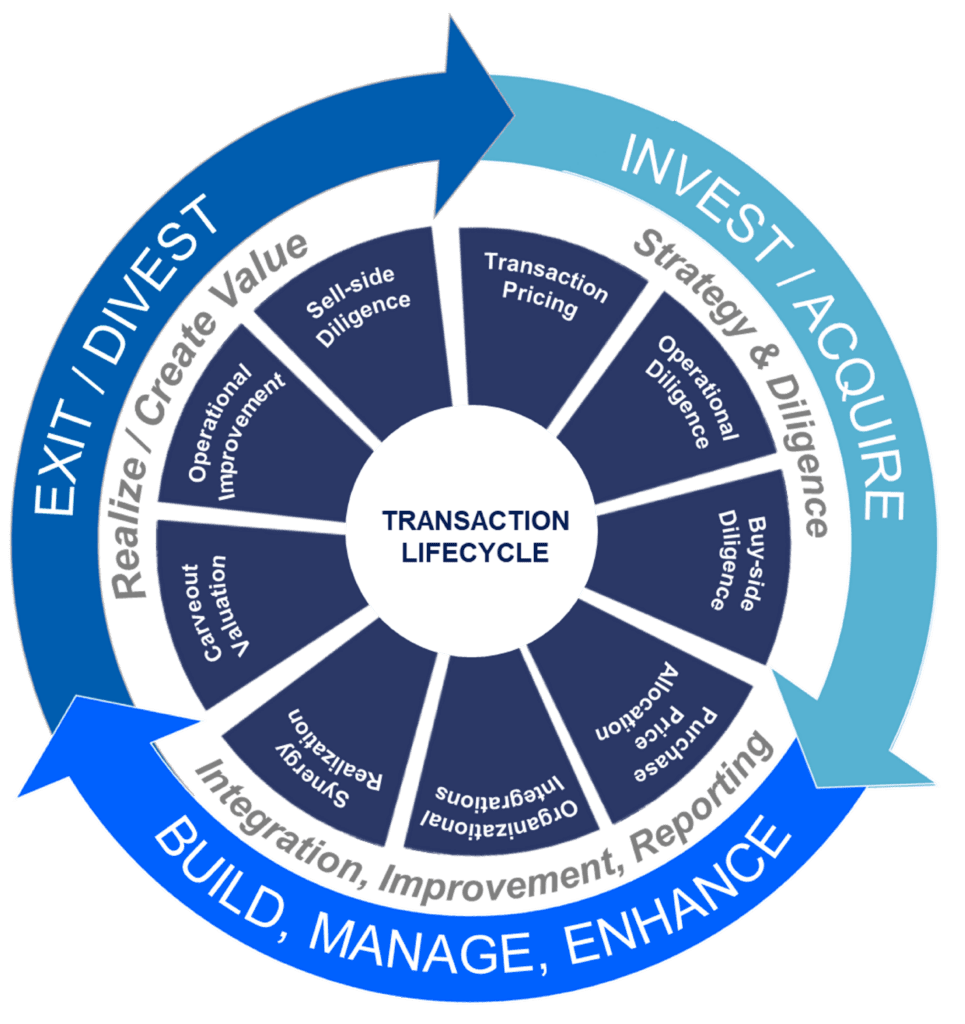

Create advanced economic structures that aid in figuring out the actual market worth of a company. Supply advisory job in relation to service appraisal to aid in bargaining and prices frameworks. Discuss one of the most suitable type of the bargain and the type of factor to consider to employ (money, supply, earn out, and others).

Establish activity plans for danger and direct exposure that have been determined. Execute integration preparation to establish the process, system, and business changes that may be called for after the deal. Make numerical quotes of assimilation costs and benefits to examine the financial reasoning of integration. Set standards for incorporating divisions, technologies, and company procedures.

Analyze the possible consumer base, sector verticals, and sales cycle. The operational due diligence offers vital insights right into the functioning of the firm to be acquired worrying danger evaluation and worth development.